Affordable Housing: A Growing Challenge in Cary

When we talk about affordable housing, we’re often referring to one of two critical aspects.

First, there’s the simple notion of housing that doesn’t strain the finances of the average person. According to the U.S. Department of Housing and Urban Development, housing is considered “affordable” when its cost doesn’t exceed 30% of the occupant’s gross income, including rent or mortgage and utilities.

The second facet revolves around housing assistance programs, designed to assist low-income individuals in securing a place to live, with their rent significantly lower than market rates. The government subsidizes the difference, ensuring that these individuals have a roof over their heads. This is a simplified explanation of how such programs work; for more comprehensive details, you can explore the U.S. Department of Housing and Urban Development’s official resources.

In Cary, when we speak about affordable housing, it’s often in the context of the first definition, and that is what this article is about. Many find themselves caught in a challenging position: making too much money to qualify for housing assistance programs but still unable to comfortably enter the housing market.

Consider this: the current average rent for a 1-bedroom apartment in Cary is $1,499. Going by the earlier definition of affordable housing, you’d need an annual income of around $60,000 to afford it. This effectively prices out many hardworking individuals, including our town’s firefighters, teachers, school bus drivers, and more, from being able to rent a one-bedroom apartment in the very community they serve.

But what about the dream of homeownership?

In 2015, the median home price in Cary was approximately $325,000. Fast forward to today, and that figure has surged to nearly $600,000. Even if you managed to find a starter home at $400,000, saved up a 20% down payment (an impressive $80,000), and closed the deal, your total monthly payment – including taxes and fees – would land at a substantial $3,024. According to the affordable housing definition, you’d need a household income of $120,960 per year to comfortably afford that house.

What is the solution?

This is an incredibly nuanced issue with no clear one-size-fits-all solution.

The town of Cary published The Cary Housing Plan in 2021, which details some possible solutions – including collaborating with regional players to create affordable housing options. This involves supporting transit-oriented development and exploring the use of publicly-owned land for affordable housing. Cary aims to build stronger ties with nonprofits and private entities in the fight for affordable housing.

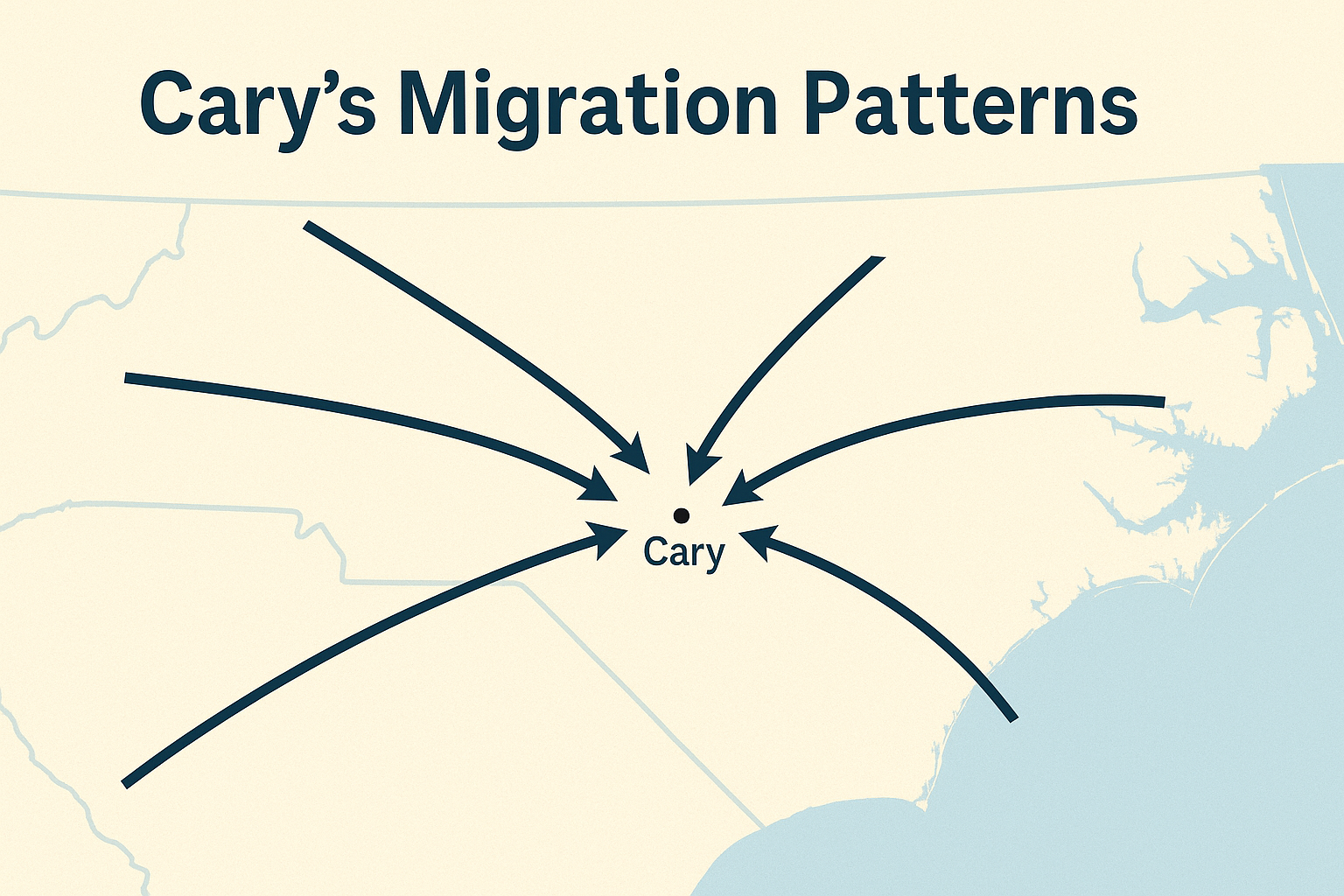

Cary is an incredibly desirable location for people to re-locate. The demand continues to grow at a pace much faster than the supply. Building new single-family homes would involve having to tear down more trees (Cary lost 7.3% of its tree canopy last year, though still about half of the total town is covered by tree canopy). Building townhomes allow for more homes to be built in a smaller space, and building apartments/condos allow for even more.

The only viable approach to alleviate the burden of soaring housing costs is by expanding the housing supply, but it doesn’t come without trade-offs. To accommodate this growth, more natural landscapes, including trees, may need to be sacrificed, and the increased housing density can lead to more traffic congestion on our roads.

As new housing developments emerge, corresponding enhancements to infrastructure must be a priority to ensure that our communities can effectively handle the additional demands on utilities, transportation networks, and public services. This involves not only creating more housing but also investing in essential upgrades to maintain the quality of life for both existing and new residents.

Balancing the need for affordable housing with environmental and infrastructure considerations remains a critical challenge in the quest for sustainable and equitable urban development, and there is no easy fix.

What if we just didn’t build more housing?

Some people have expressed that Cary is growing too fast, and that we should stop building more housing in an attempt to slow the growth. If we did that, housing costs would skyrocket, pricing out many people that have lived here all of their lives. Folks that already own a home would benefit from a great deal of equity, but many, including retirees on fixed incomes, would struggle with paying property taxes on their newly evaluated home.

The shortage of affordable housing could also hinder economic growth as it becomes increasingly challenging for workers to find suitable homes near their workplaces. Ultimately, without new home construction, the very fabric of communities could unravel as housing instability and inequality rise, posing severe social and economic challenges.

Not building isn’t an option, and too much building could have negative consequences as well.

Striking a balance

The issue of affordable housing is a multifaceted challenge, one that requires a careful balancing act. While the expansion of the housing supply is essential to alleviate the burdens of skyrocketing costs, it is not without consequences, both in terms of environmental impact and infrastructure demands.

Ultimately, the pursuit of affordable housing is a dynamic process that involves not just the construction of physical structures but the nurturing of vibrant, inclusive communities where everyone has the opportunity to call a place “home.”

Many folks from all different backgrounds call Cary their home, and I think we would all like to keep it that way.